In this article, we’ll break down the essentials of investment property deductions, so you can make informed decisions and optimise your financial strategy. By delving deeper into each category of deductions and providing practical tips, we aim to equip you with the knowledge necessary to take full advantage of your investment property.

Understanding Investment Property Deductions

Investment property tax deductions are expenses that you can subtract from your rental income to determine your taxable income. By effectively claiming these deductions, you can reduce the amount of tax you owe on your investment property income, thereby improving your profitability. This aspect of property management is often overlooked by new investors, but it plays a crucial role in the financial success of your investment.

To fully grasp the potential of tax deductions, it’s essential to understand the broad spectrum of expenses that qualify. From everyday operational costs to more substantial capital expenditures, recognising these deductions can transform your investment strategy. Not only do these deductions lower your tax liability, but they also offer an opportunity to reinvest savings into further enhancing your property’s value and income potential.

The tax office allows a range of deductions related to the costs of managing, maintaining, and earning income from your investment property. These expenses are typically divided into two categories: operating expenses and capital expenses. Understanding these categories is fundamental to effectively managing your investment property finances.

Operating Expenses vs. Capital Expenditures

Operating Expenses: These are day-to-day costs necessary for running your investment property, such as property management fees, insurance, and repairs. Operating expenses are generally fully deductible in the year they are incurred, providing immediate tax relief. Regularly reviewing and understanding these expenses can lead to more strategic financial planning and better cash flow management.

Capital Expenditures: These involve expenditures on improvements or assets that add value to your property, like renovations or purchasing new appliances. Unlike operating expenses, capital expenditures are not immediately deductible. Instead, they are depreciated over time, which allows for a more extended period of tax benefits. This category of expenses requires careful planning and documentation to ensure all potential deductions are realised.

Key Deductible Expenses for Investment Properties

To make the most of your investment property, it’s essential to be aware of the deductions you can claim. Here are some of the most common deductible expenses:

Mortgage Interest

The interest on your mortgage for the investment property is often one of the largest deductions. This includes interest on loans taken to purchase or improve the property. By claiming this deduction, you effectively reduce the cost of borrowing, which can significantly impact your overall return on investment. It’s essential to keep detailed records of all interest payments to ensure you can substantiate your claims.

Council Rates

The annual council tax you pay to local authorities is deductible. Keeping track of these payments ensures you claim the correct amount. Staying informed about any changes in council tax rates or assessments is also crucial, as these can affect your deductions and overall property expenses.

Property Management Fees

If you employ a letting agency or property management company to handle tenant interactions and maintenance, those fees are deductible. This deduction can help offset the cost of professional management, allowing you to focus on other investment opportunities. A well-managed property often results in higher tenant satisfaction and reduced vacancy rates, further enhancing your investment’s profitability.

Repairs and Maintenance

Expenses for repairs that keep your property in good working condition can be claimed. However, note that improvements or renovations that enhance the property’s value are considered capital expenses. Distinguishing between repairs and improvements is crucial, as it affects how and when you can claim these expenses. Regular maintenance not only ensures a safe and appealing property but also helps prevent more costly repairs in the future.

Depreciation

Depreciation allows you to deduct the cost of wear and tear on the property and its fixtures over time. It’s a non-cash deduction, meaning it doesn’t require you to spend money each year to claim it. Understanding the depreciation process can be complex, but it is a vital tool for investors looking to maximise their tax benefits. Engaging a professional to prepare a detailed depreciation schedule can help ensure accuracy and compliance.

Utilities

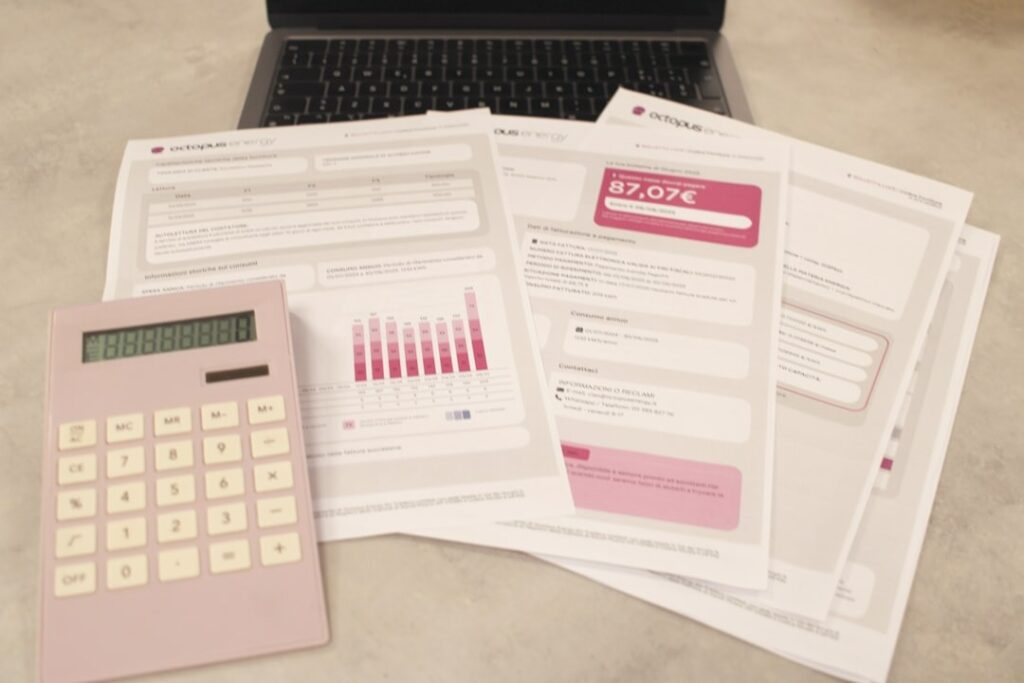

If you pay for utilities such as water or electricity for your tenants, these costs can be deducted. This deduction is particularly relevant for properties where utilities are included in the rent, as it can represent a significant portion of operating expenses. Clear documentation and billing records are essential to substantiate these claims.

Insurance Premiums

The cost of insuring your investment property is deductible, including landlord insurance that covers rental defaults or property damage. Insurance is a critical component of risk management, protecting your investment from unforeseen events. Regularly reviewing your insurance coverage ensures you have adequate protection and are maximising your deductible expenses.

Non-Deductible Expenses to Avoid

While the list of deductible expenses is extensive, there are costs that you cannot claim against your investment property income. Understanding these is vital to avoid audit triggers and potential penalties. Being aware of these non-deductible expenses helps maintain accurate financial records and ensures compliance with tax laws.

Personal Expenses

Any expenses that are personal in nature, such as travel costs for leisure or personal use of the property, are not deductible. Mixing personal and business expenses can lead to complications and potential issues during tax audits. Clear separation of personal and investment property expenses is essential for accurate reporting and compliance.

Acquisition Costs

Expenses incurred in purchasing the property, such as conveyancing fees and stamp duty, are not immediately deductible. Instead, they form part of your property’s cost base and can impact capital gains tax when you sell. Keeping detailed records of these costs is crucial, as they play a significant role in determining your property’s overall tax liability upon sale.

Initial Repairs

Repairs required when you first purchase the property to make it rentable are considered capital expenses. These cannot be deducted immediately but can be depreciated over time. Understanding the distinction between initial repairs and ongoing maintenance is vital for proper tax reporting and maximising your deductions.

Optimising Your Investment Property Deductions

To fully capitalise on your investment property, consider the following strategies to optimise your tax deductions:

Maintain Meticulous Records

Accurate and organised record-keeping is essential. Maintain receipts, invoices, and documentation of all expenses related to your investment property. This will make filing taxes and substantiating your claims far easier. Implementing a systematic approach to record-keeping not only streamlines the tax filing process but also provides valuable insights into your property’s financial performance.

Seek Professional Advice

Consider hiring a tax professional or accountant with expertise in real estate investment. They can help identify all the deductions you’re entitled to and ensure compliance with tax laws. A knowledgeable professional can also provide strategic advice, helping you plan for future tax liabilities and optimise your investment strategy.

Plan for Capital Gains Tax (CGT)

While deductions can reduce your taxable income, it’s important to plan for potential capital gains tax (CGT) liabilities if you decide to sell the property. Understanding how CGT works and keeping a record of all capital expenses can help minimise your tax burden when selling. Proactive planning can significantly impact your net return on investment and provide clarity on your long-term financial goals.

Utilise a Depreciation Schedule

Utilise a professional to prepare a depreciation schedule. This will ensure you’re claiming the correct depreciation amounts each year, maximising your deductions without running afoul of tax regulations. A well-prepared depreciation schedule can provide significant tax savings over the life of the investment, enhancing your property’s overall profitability.

Investment property tax deductions are a powerful tool for enhancing your investment returns. By understanding what you can and cannot claim, you can effectively manage your property’s profitability while complying with tax laws. With careful planning and the right professional guidance, you can navigate the complexities of property investment and set yourself on a path towards financial success.

Whether you’re a seasoned investor or just starting, taking advantage of these deductions can make a significant difference in your financial outcomes. Remember, the key to successful investment lies in being informed and prepared. By leveraging the full range of available deductions and implementing strategic financial practices, you can achieve long-term growth and stability in your investment endeavours.

Ready to Maximise Your Investment Property’s Potential?

Navigating the intricacies of investment property deductions can be complex, but you don’t have to do it alone. Our expert financial advisors are here to help you optimise your tax strategy, ensure compliance, and unlock the full profitability of your property investments.

Don’t leave money on the table. Contact MW Group today for a personalised consultation and take control of your financial future.

Explore our other resources for property investors: